Be accountable for the way you improve your retirement portfolio by using your specialized awareness and passions to take a position in assets that in shape with your values. Got experience in property or private fairness? Use it to support your retirement planning.

Regardless of whether you’re a money advisor, investment issuer, or other economical professional, explore how SDIRAs could become a robust asset to mature your enterprise and accomplish your Skilled objectives.

Real estate property is one of the most popular solutions between SDIRA holders. That’s due to the fact you'll be able to spend money on any kind of real estate which has a self-directed IRA.

Bigger investment possibilities indicates you may diversify your portfolio past shares, bonds, and mutual funds and hedge your portfolio in opposition to market fluctuations and volatility.

Occasionally, the service fees connected to SDIRAs could be higher plus much more difficult than with an everyday IRA. It's because of your elevated complexity connected with administering the account.

Increased Charges: SDIRAs generally feature better administrative prices in comparison with other IRAs, as sure aspects of the administrative procedure cannot be automated.

This incorporates knowledge IRS restrictions, taking care of investments, and averting prohibited transactions that would disqualify your IRA. An absence of knowledge could result in costly issues.

Consumer Help: Try to look for a provider which offers devoted help, like use of proficient specialists who will remedy questions on compliance and IRS policies.

Entrust can assist you in paying for alternative investments with the retirement money, and administer the purchasing and advertising of assets that are usually unavailable via banking companies and brokerage firms.

Moving money from a person sort of account to a different variety of account, including transferring resources from the 401(k) to a traditional IRA.

Simplicity of use and Technological innovation: A person-friendly platform with on the internet instruments to track your investments, post files, and manage your account is critical.

Set only, when you’re searching for a tax efficient way to develop a portfolio that’s a lot more personalized for your pursuits and knowledge, an SDIRA could possibly be the answer.

Consequently, they have an inclination not to promote self-directed IRAs, which provide the flexibleness to speculate in a broader variety of assets.

Many traders are stunned to discover that making use of retirement resources to speculate in alternative assets has been possible considering that 1974. Nonetheless, most brokerage firms and banks give attention to supplying publicly traded securities, like shares and bonds, mainly web because they absence the infrastructure and experience to deal with privately held assets, for example real estate or personal fairness.

Generating essentially the most of tax-advantaged accounts permits you to continue to keep a lot more of The cash that you commit and get paid. According to whether you select a conventional self-directed IRA or simply a self-directed Roth IRA, you've the likely for tax-absolutely free or tax-deferred growth, presented certain situations are satisfied.

IRAs held at banks and brokerage firms offer limited investment alternatives to their shoppers given that they do not need the skills or infrastructure to administer alternative assets.

When you’re searching best site for a ‘established and neglect’ investing system, an SDIRA almost certainly isn’t the right alternative. Since you are in overall control over each investment made, It is really up to you to carry out your individual homework. Keep in mind, SDIRA custodians will not be fiduciaries and cannot make suggestions about investments.

The primary SDIRA policies from the IRS that investors need to understand are investment limits, disqualified people, and prohibited transactions. Account holders have to abide by SDIRA principles and regulations in order to protect the tax-advantaged status in their account.

Complexity and Duty: With an SDIRA, you have extra Command about your investments, but You furthermore mght bear a lot more responsibility.

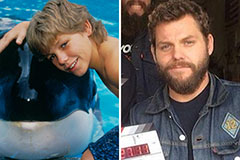

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!